Tsakos is a well run tanker shipping company with strong insider ownership and a long-term track record as a publicly listed company, dating back to the 1990s.

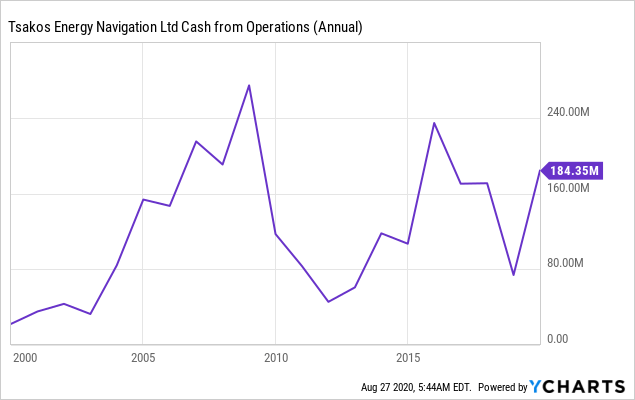

Tsakos has managed to produce positive cash from operating activities, even in the most challenging times.

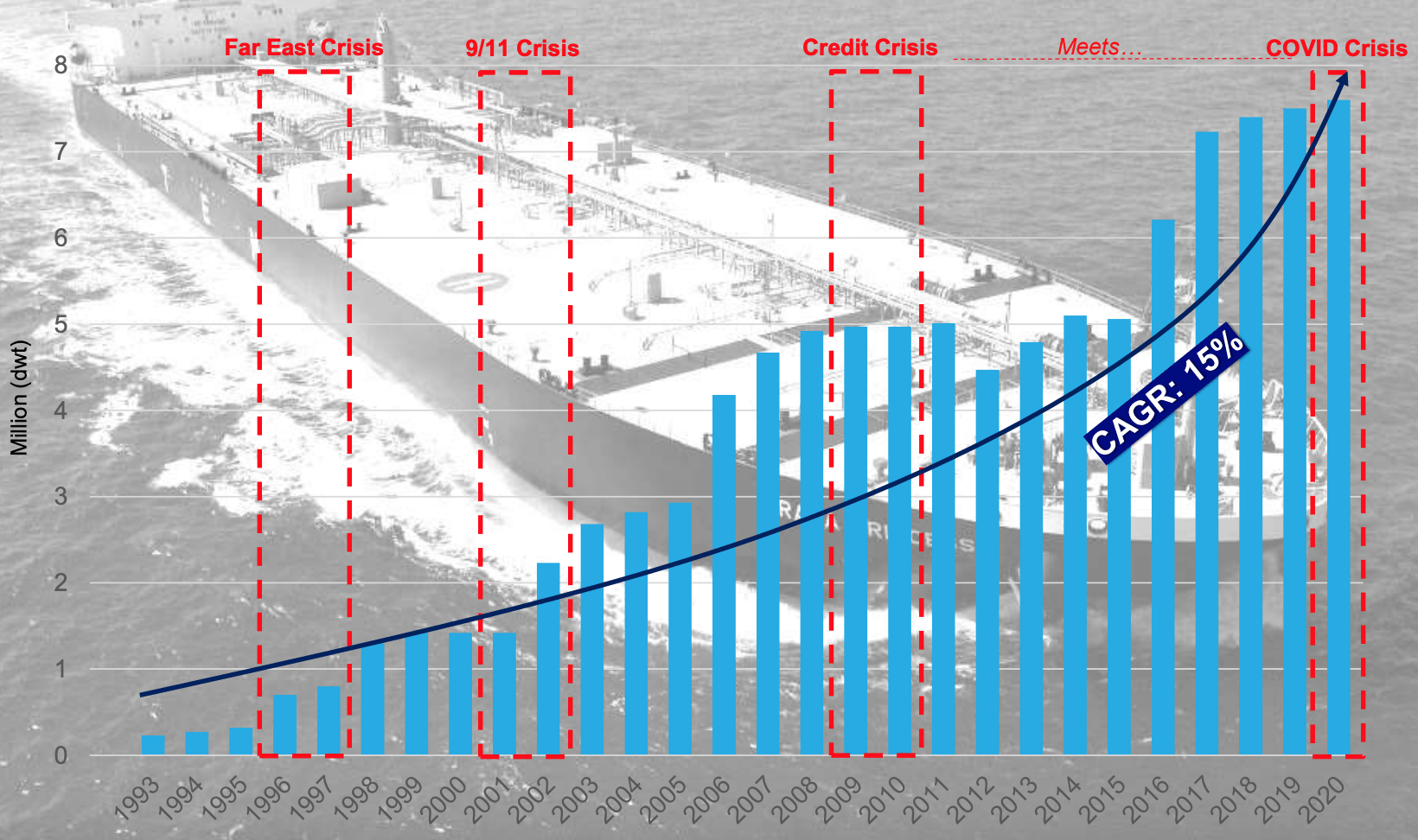

Tsakos has been through the Asian Financial Crisis, 9/11, Great Recession and currently COVID-19, yet it consistently managed to grow its fleet and has always paid a common dividend.

Not only this, Tsakos even paid a special dividend in June 2020. The company is serious about paying down debt, which has decreased by ~$280M since the peak in 2017.

I have been a long-term holder of various preferred shares, acquiring them below par value, locking in 10%+ yields. As of recently, I am also long the common shares which continue to hover around all-time lows.

Tsakos Energy Navigation (TNP) is a well run tanker shipping company with strong insider ownership and a long-term track record as a publicly listed company, dating back to the 1990s. TNP's common shares were first listed in 1993 on the Oslo Stock Exchange and the Bermuda Stock Exchange, although de-listed from Oslo in March 2005 due to limited trading. The US listing took place in March 2002. Since its listing, TNP has always paid a common dividend, despite navigating through many challenges like the Asian Financial Crisis (1996-97), the September 11 attacks, the Financial Crisis (& Great Recession) as well as the current COVID-19 pandemic.

Source: Q1 2020 Presentation

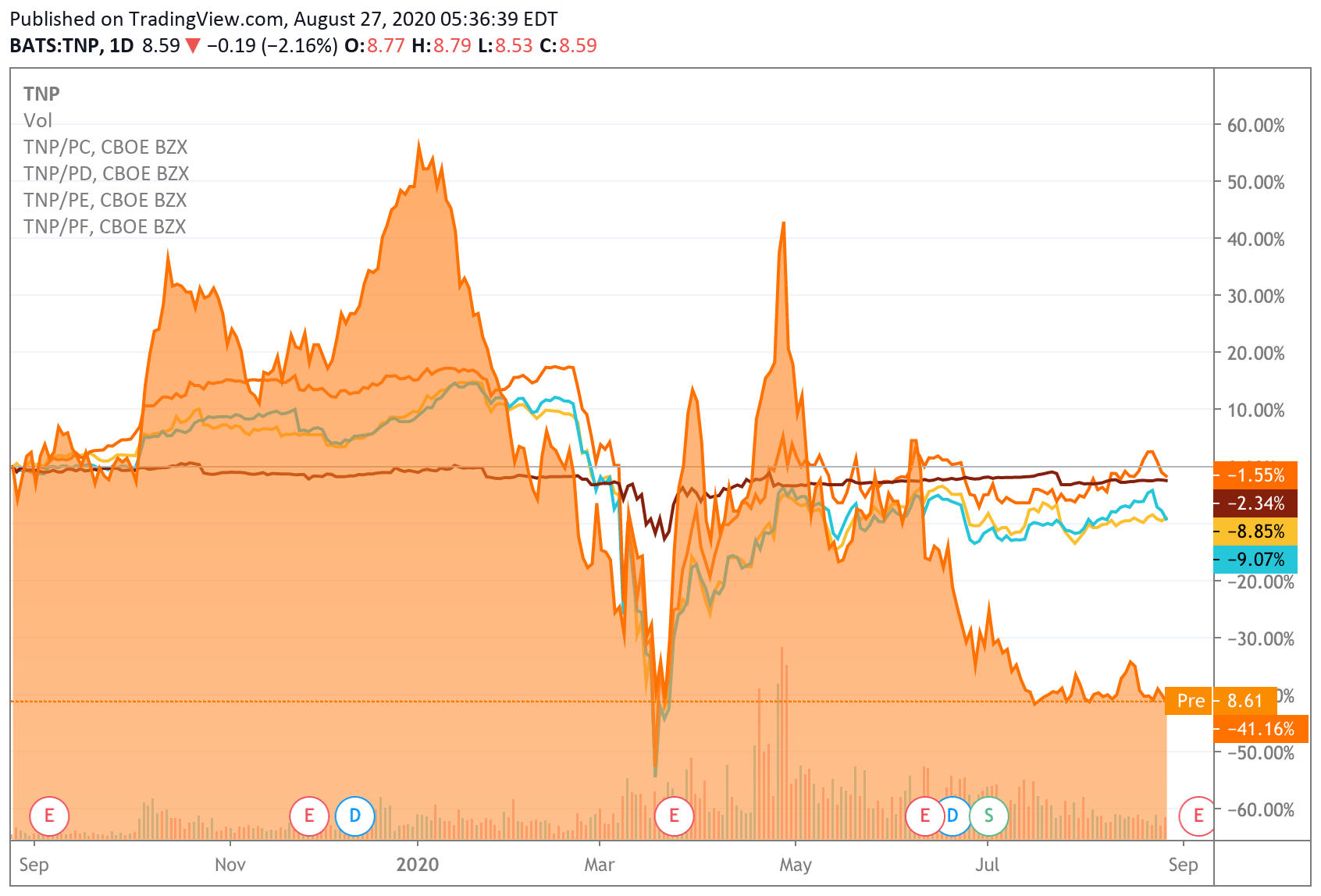

I have been a long-term holder of the preferred shares, acquiring them below par value. I still find the preferred shares attractive income stocks, as most continue trading below par, carrying a 10%+ yield with 20%+ capital gain potential. TNP has several preferred series, namely:

- Series C (TNP.PC) - price: 25.24, dividend yield: 8.80%

- Series D (TNP.PD) - price: $21.00, dividend yield: 10.43%

- Series E (TNP.PE) - price: $19.75, dividend yield: 11.70%

- Series F (TNP.PF) - price: $19.88, dividend yield: 11.95%

Note all series have par value of $25. I tend to avoid owning/holding preferred shares above par value. At the moment, I own a basket of all preferred shares, with the exception of Series C, adding during large dips here and there, depending on market conditions and other opportunities.

I recently added to the common shares as well since I believe the company is doing the right things, yet the share price is hovering around all-time lows. I like the company's diversified fleet, ranging from crude tankers (VLCCs, suezmaxes, etc) and product tankers (MRs, LRs) to shuttle tankers and LNG carriers.

I like that the company does not speculate on newbuildings and strives to order vessels with charters attached, like the recently announced long-term charters for up to 3 newbuilding suezmax DP2 Tankers, adding $250M in minimum time charter income.

I like the company's chartering policy, with fixed-rate contracts to cover its obligations while also maintaining vessels on spot exposure. Based on current vessels in spot contracts only, for every $1,000 per day increases in spot rates there is a positive impact of $0.08 in annual EPS.

I like that TNP is serious about reducing is debt load through operating cash flow. The total loan balance has decreased by ~$280M since the peak in 2017, from $1.76Bn in December 2017 to $1.48Bn at the end of Q1 2020. This trend is set to continue, despite rewarding shareholders (such as the special dividend payable in June 2020).

TNP has always been conservatively managed, maintaining a healthy cash balance (currently in excess of $200M) with prudent debt levels, low OPEX and a conservative chartering policy. These are important factors as to why TNP has consistently managed to produce positive cash from operating activities, even in the most challenging times, which is comforting for preferred holders (as to the ability to pay dividends).

What's more, as mentioned above, TNP has always paid a common dividend, irrespective of market cycles. I also find this comforting as a preferred shareholder, since the preferred shares are higher up in the capital structure. As such, all preferred dividends must be paid first, in full, otherwise common shareholders are not entitled to a dividend.

Until now, the preferreds have been the place to be in, significantly outperforming the common shares, based on various time frames, even going back 5 years. For instance, based on a 1-year timeframe, the preferreds have been down a bit (ranging from -1.55% to -9.07%), while the common is down by more than 40%. Including dividends, the total return for the preferreds has been positive.

Source: Seeking Alpha

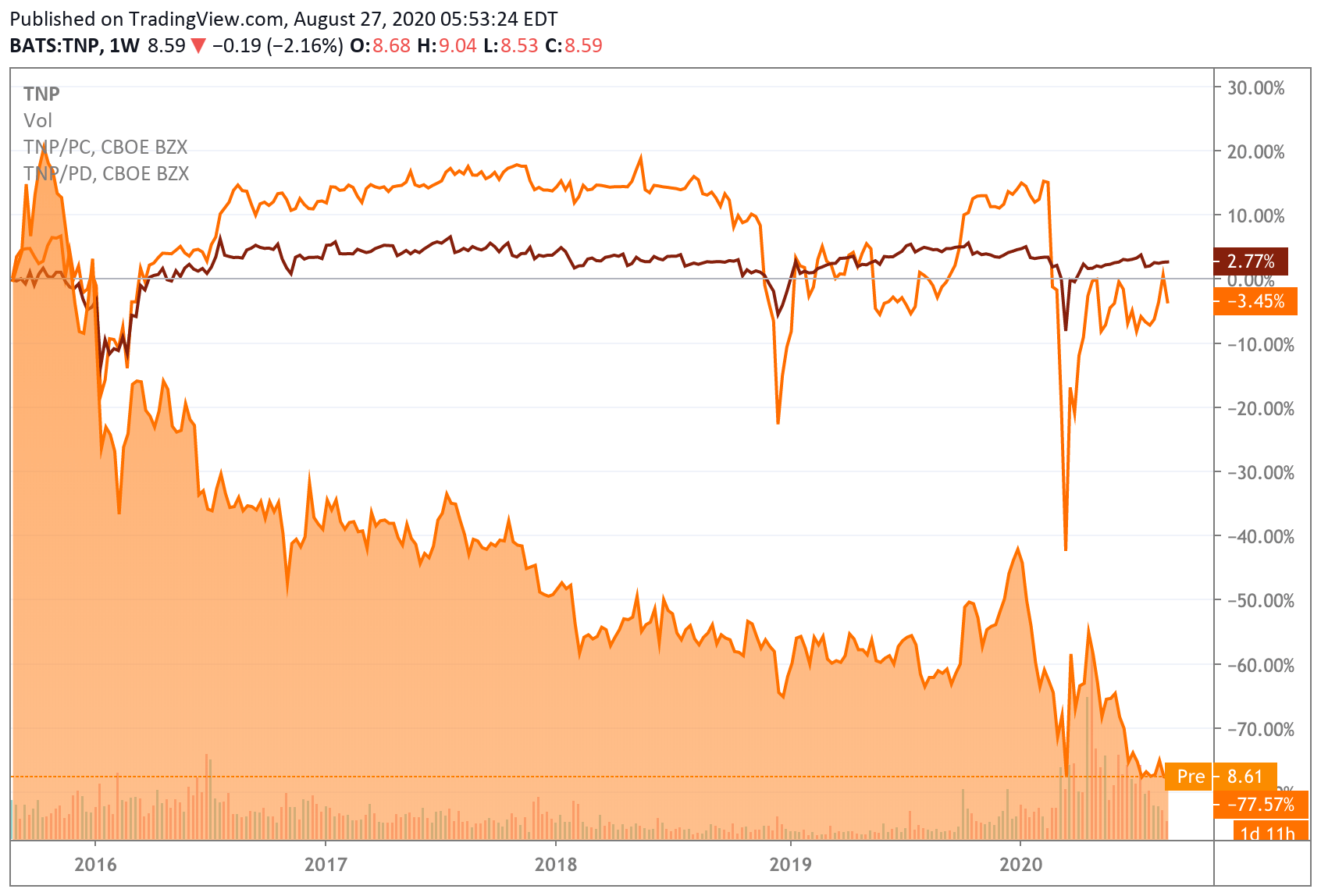

Over a 5-year time frame (note Series E and F didn't exist for the entirety of this time frame) the preferred shares (Series C and D) have outperformed the common shares by a very wide margin; the preferreds have been marginally down (ranging from -2.77% to -3.45%), while the common stock is down by almost 80%. Including dividends, the total return for the preferreds has been significantly positive. For example, TNP.PD pays an annual dividend of $2.19 per share, meaning almost $11 per share over the 5-year period in question, a ~50% total return driven solely by dividends.

Source: Seeking Alpha

In closing, since the company has successfully navigated various devastating crises, and given the fairly conservative nature of company's employment policy, which provides cash flow sustainability and visibility, I feel comfortable that preferred shareholders will keep on receiving dividends. I have been a long-term holder of TNP's preferred shares, always acquiring them below par value. I still find them attractive, as they continue to trade below par value, carrying a 10%+ yield with substantial 20%+ capital gain potential. Being mindful that the preferreds are the place to be in, I recently also initiated a position in the common shares since they continue to hover around record-low levels. In general, shipping is severely out of favor but things can always change.

Disclosure: I am/we are long TNP.PD, TNP.PE, TNP.PF, TNP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.