According to Articles 19 and 20 of Incorporation of O.P.F., both the type and the manner of payment of the contribution are defined, namely:

REGULAR CONTRIBUTION OF INSURED MEMBERS

Every insured member of the Fund may pay a monthly contribution (regular insured contribution), the amount of which may not be less than €30 and not more than €5,000 (U.S.Dollar Equivalent).

By affiliation to the insurance, insured members submit to the Fund a statement choosing the amount of their regular monthly contribution.

Insured members may amend their statement at any time and increase or decrease the amount of their regular monthly contribution. The change of the contribution shall take effect on the first day of the month following the submission of the relevant declaration. (download document here).

The amount of the regular monthly contribution of insured members is withheld by the employer and is remitted to the Fund until the last day of the following month to which they refer. The contribution of this paragraph is withheld 12 times a year. For this purpose, insured members authorize employers to withhold from their regular monthly earnings the amount of the regular contributions they have stated.

Insured members whose regular contributions are not withheld from their payroll, must pay the amount directly to a bank account indicated by the Fund.

It should be noted that if there is a regular employer contribution, as described in the next section, the regular insured contribution is classified as optional.

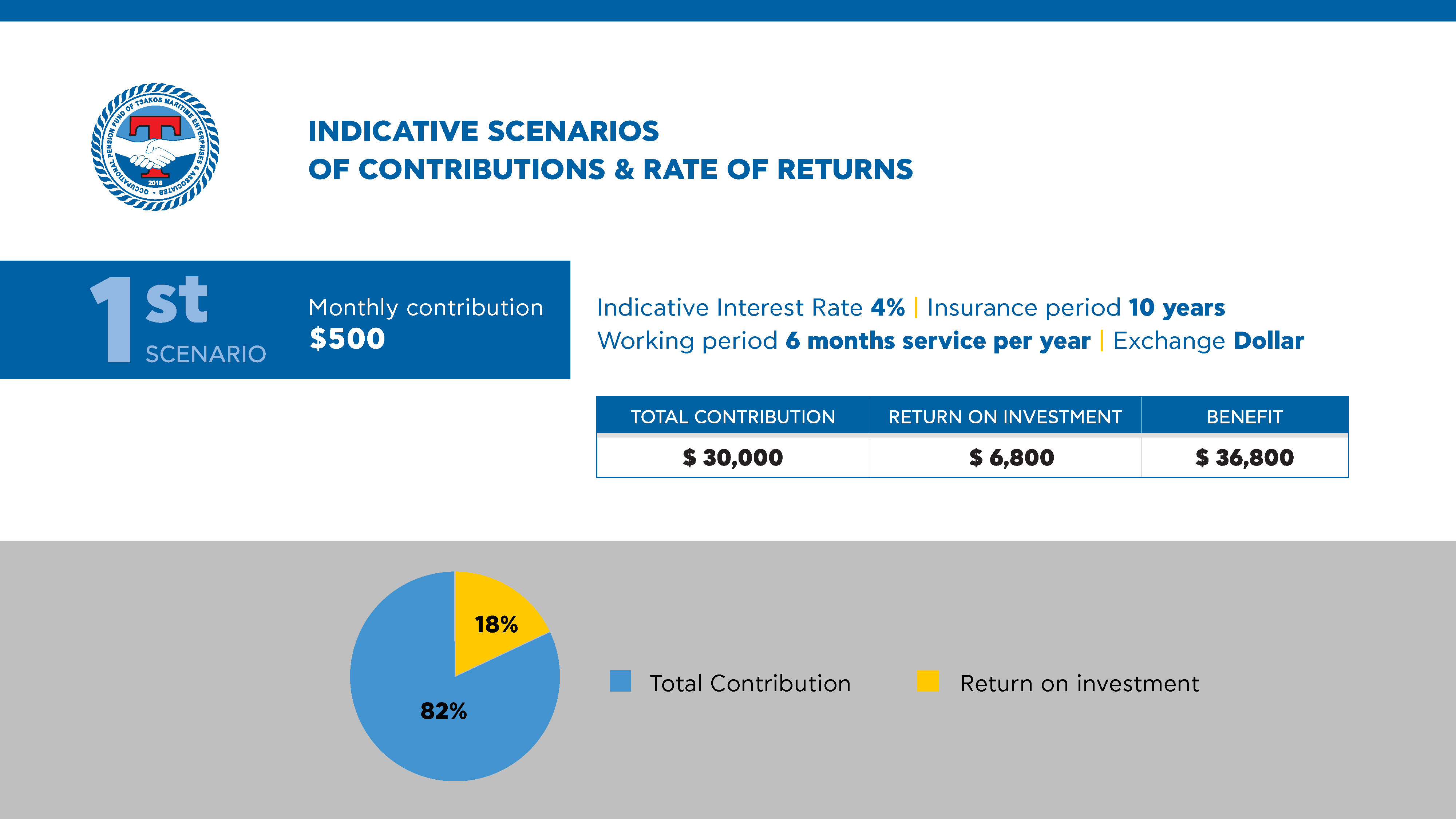

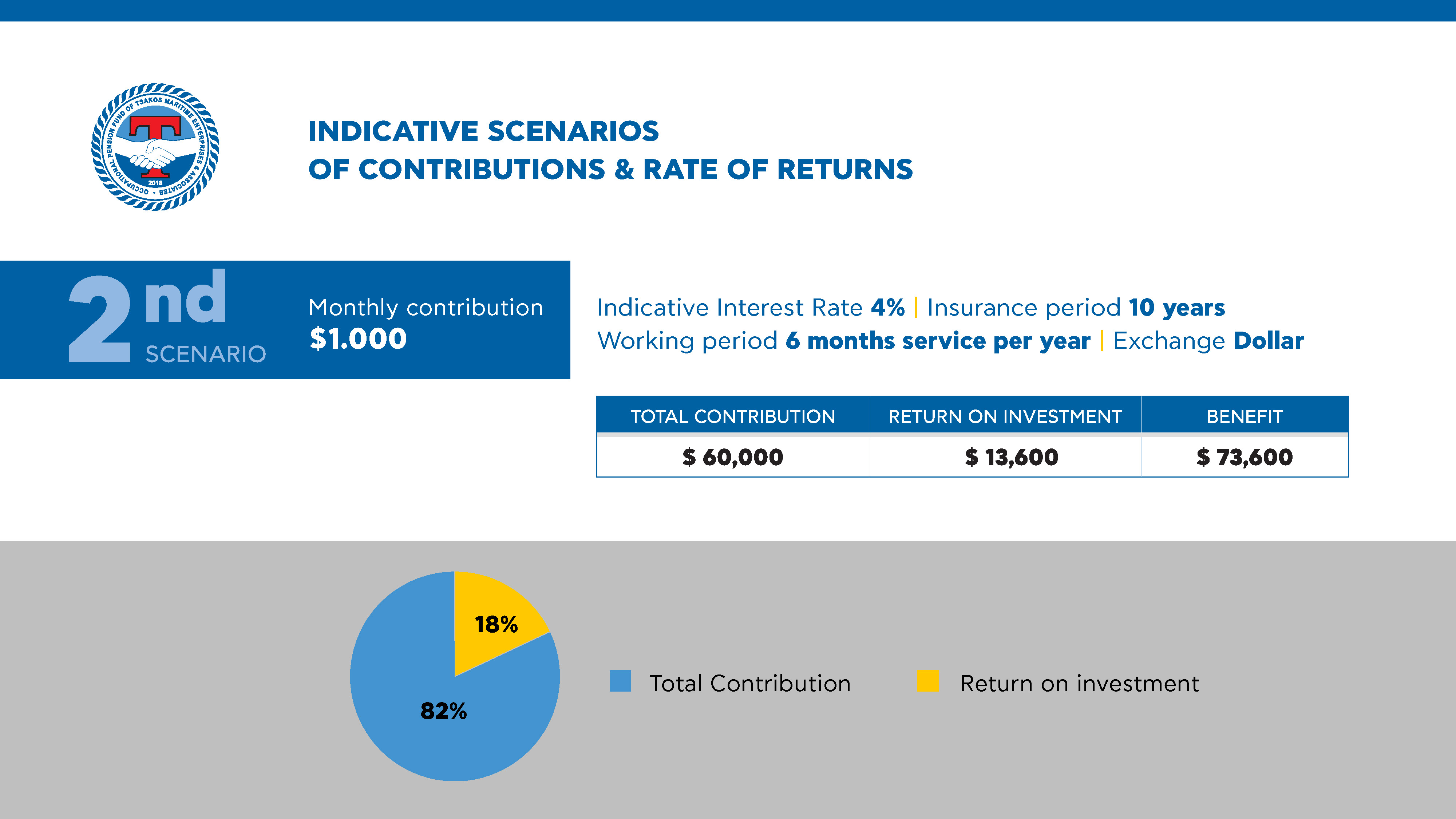

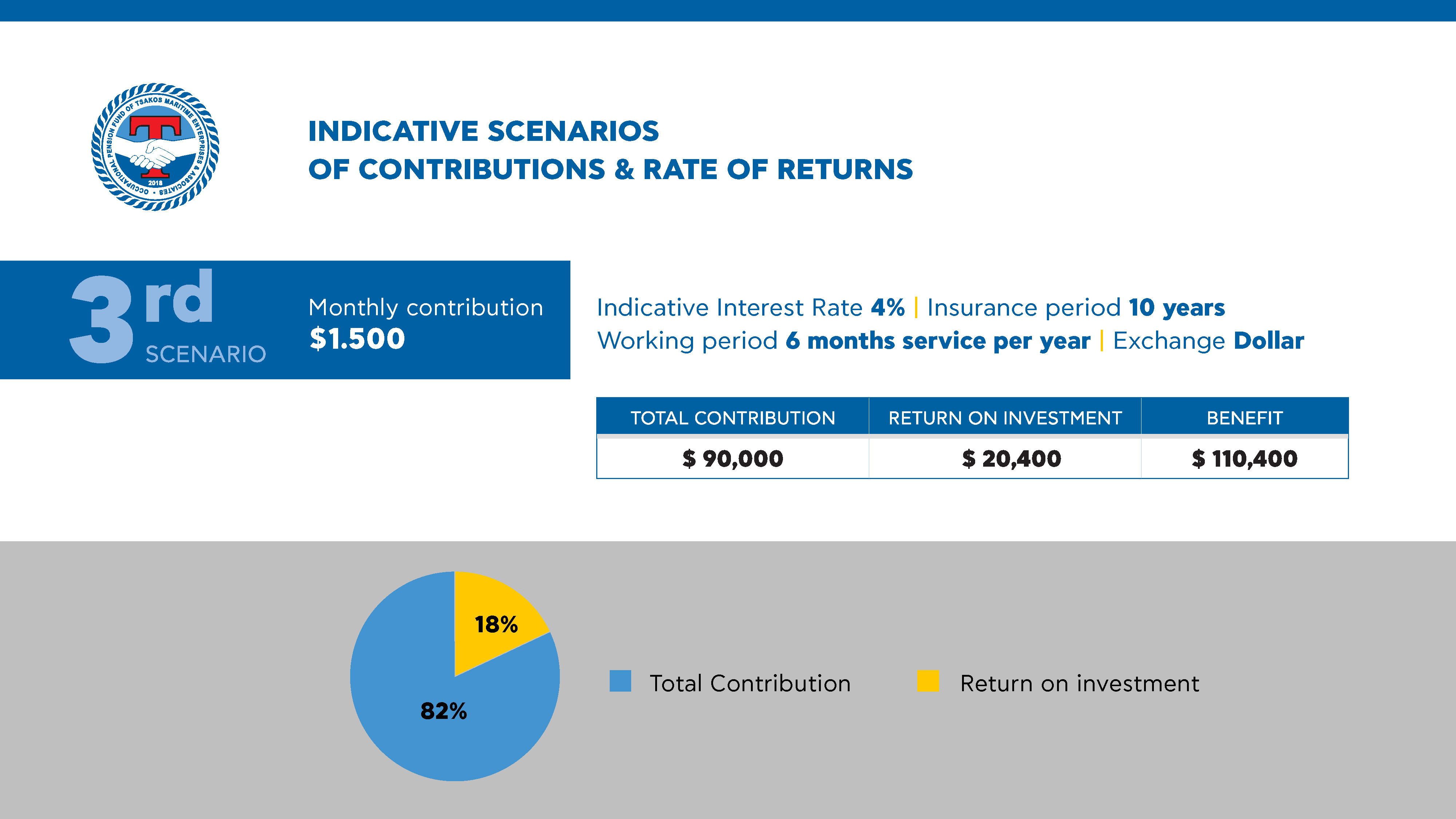

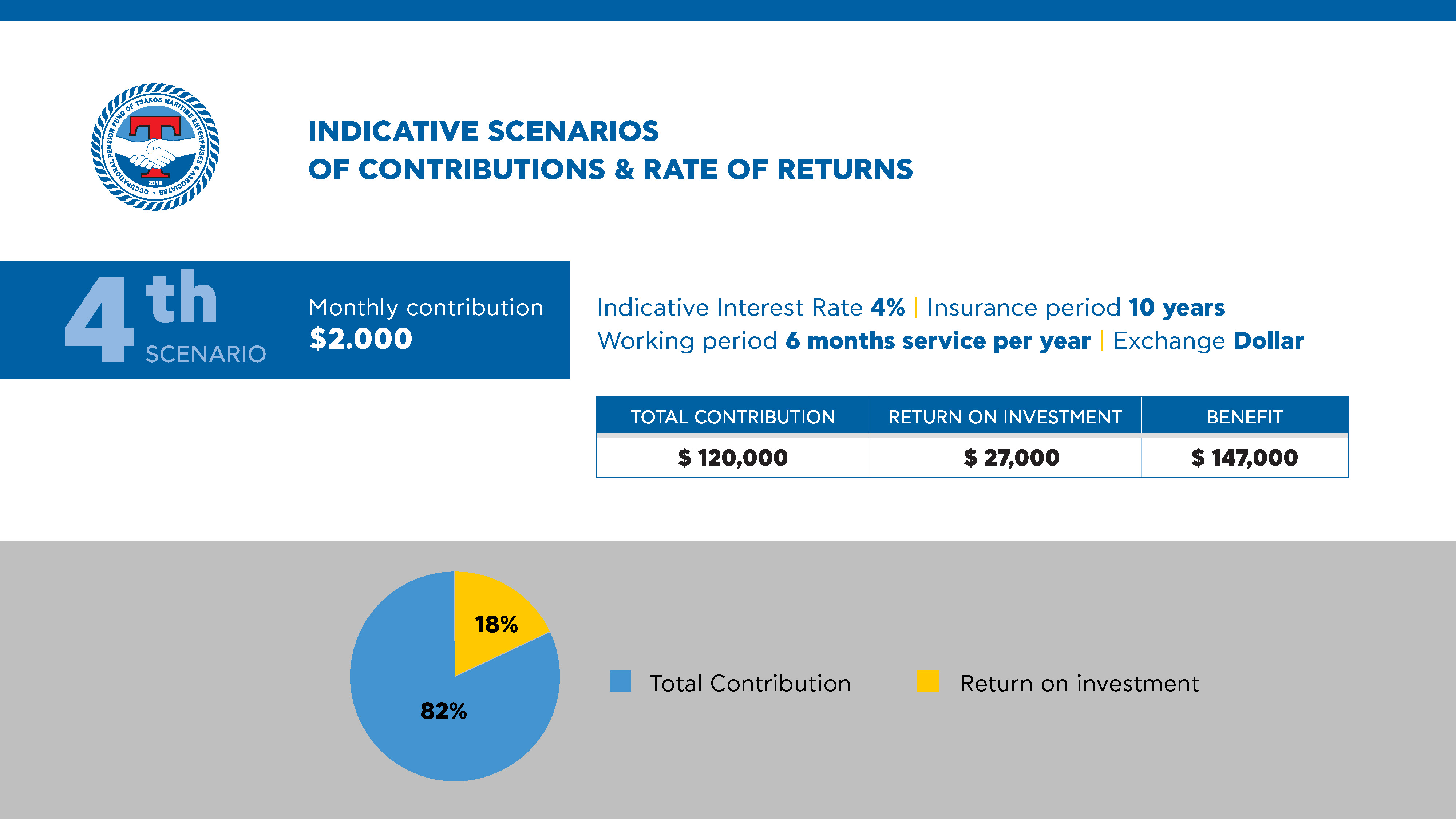

EXAMPLES

______________________________________________________________________________________________________

______________________________________________________________________________________________________

REGULAR CONTRIBUTION OF EMPLOYER COMPANY

The employer company Tsakos Shipping and Trading S.A. pays for each insured member referred to in Article 4 (a) every month a regular employer contribution comprising 1 % of his monthly salary (net remuneration). Contribution is also calculated on Christmas, Easter, and Leave of absence Bonuses. The earnings on which a contribution is calculated do not include payments more than statutory allowances and any other voluntary and freely transferable benefit to the employer. The regular employer's contributions are paid until the last day of the next month to which they refer.

For insured persons referred in Article 4 par. b,c, and d, the regular monthly employer contribution is optional, and the following cases apply:

- If a regular employer's contribution is agreed, it is a percentage of the insured's monthly salary (net remuneration) as described in the previous paragraph. The amount of the rate is selected by the employer company concerned with the agreement of the Fund's Board of Directors and is the same for all the insured persons concerned.

- On the contrary, if a regular employer's contribution is not paid, a regular monthly employee's contribution shall be paid within the limits referred to in paragraph 1 so that the insured person retains his insurance status in the Fund.

For insured members who are seafarers and do not provide seagoing services onboard a vessel of the Group's companies for more than one year from their previous employment (unless a written request made by the insured and respective acceptance by the Board of Directors of the Fund, its suspension can be prolonged for another year), according to Article 4 par. 2, for as long as they are not self-employed the obligation to pay regular contributions of employer and employee is suspended. During this period, payment of the regular employer's and employee's insurance contributions is suspended. Suspension time is considered as time of insurance in the Fund.

The above shall also apply as referred to in Article 4, par. 2 at a time when the employer does not provide insured members with work:

- due to unpaid leave

- due to illness

- due to parental leave

- for work abroad and/or domestically if the employment was done on secondment, a loan agreement and generally under the instructions of the employer company; and

- due to military service.

It is highlighted that non-payment of regular monthly contributions (insured or/and employer) entails the non-crediting of the insured person's personal account and failure to consider the corresponding period as insured time in the Fund.

SPECIAL CONTRIBUTION OF INSURED MEMBERS

Every insured person is entitled to pay special contributions by declaring to the Fund the amount he wishes to pay.

The special contribution may be paid by the following ways:

- The insured persons authorize the employer company to withhold from their payroll the amount and pay the special contribution to the Fund, provided that they have informed the Fund accordingly in writing.

- Alternatively, the amount of the special contribution of an insured person will be deposited in a bank account of the Fund, which will be indicated by the Fund.

SPECIAL CONTRIBUTION OF EMPLOYER COMPANY

Employer companies are entitled to pay special contributions which are credited to the Individual Account of the Insured upon written notice and with the approval of the Board of Directors of the Fund.